Plan Framework

Housing

Housing Snapshot

The Midtown Regional Center has just over 6,000 households and is growing faster than the City of San Antonio overall, adding almost 800 households since 2010. The average annual household growth of 2.3% is much faster than the City-wide average of 1.0%. Midtown has a median household income of $30,750, which is lower than the city-wide average, partly due to a large student population and collection of public housing units.

There are currently 7,340 housing units in the Midtown Regional Center. Vacancy in the area is much higher than the City average, with 17% of Midtown housing units vacant. The high vacancy rate may be driven by the large number of recently built housing projects. However, it may also be an indication of a significant number of housing units being used as short-term rental units.

The housing stock in Midtown is a mixture of housing types, age and quality. The housing stock in Midtown is split between much older and much newer homes. Since 2010, there have been 192 for-sale homes built and over 1,500 apartments developed in Midtown.

The area has a higher concentration of renters than the City as a whole, with 75% of occupied housing units rented, compared to 47% across the City. Most of these rentals are in low-density housing; 57% of rental units are in buildings with 4 or fewer units.

Housing affordability is measured in terms of “cost burden” or the share of income paid towards housing costs. In general, if a household spends more than 30% its gross income on housing costs it is considered to be a “cost burdened” household. Generally, homeowner affordability is not a significant issue in the Midtown area; however, recent changes in the market are impacting homeowner affordability. The average home price in Midtown in 2017 was $358,000 and has increased by 9 percent annually over the past five years. Overall, 24% of homeowners in the area are cost burdened, paying over 30% of income towards housing, a figure on par with the County average. However, this percentage has increased from 17% to 24% since 2000.

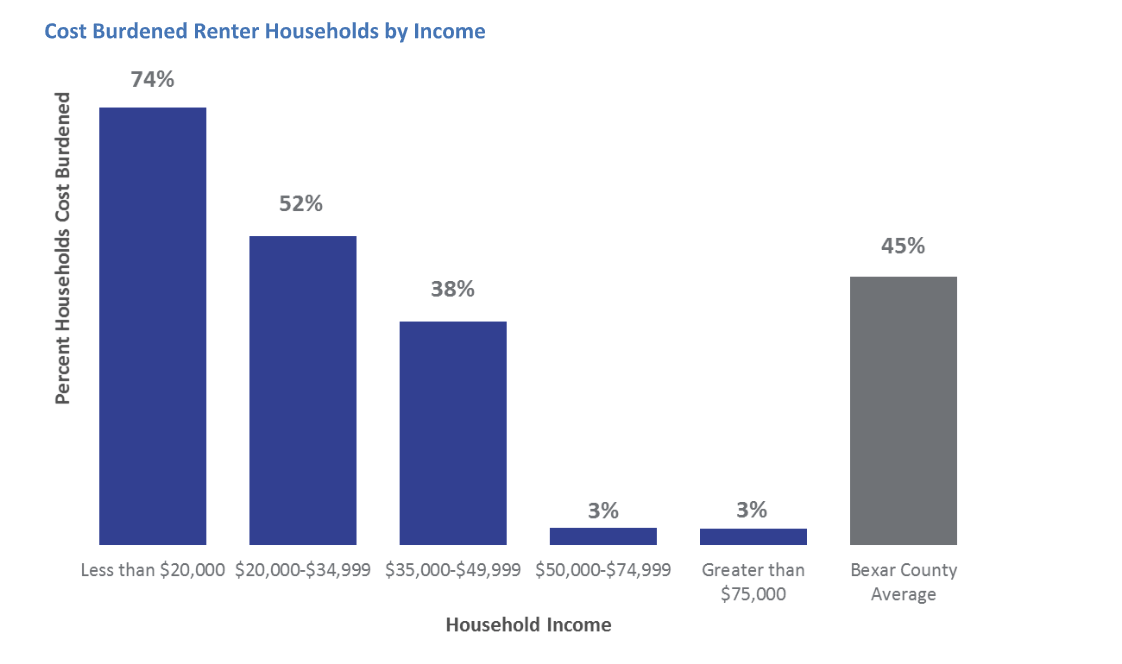

The affordability of renting in Midtown is growing concern. The average rent for apartments in the Midtown Regional Center is $1,276 per month and average monthly rents have increased by $650 since 2010, which is almost twice the County’s average increase. Cost burden is a growing issue for low-income renters in Midtown, with 74% of renter households earning less than $20,000 and 52% of renter households earning between $20,000 and $35,000 spending over 30% of income on rent. There are a higher number of renters in single family homes which raises concerns of potential displacement of residents as lower income renters in single family homes are the most vulnerable to impacts of rising rents and property values.

Housing issues and strategies were primary topics of discussion at Community Meeting #2 and Planning Team Meeting #5, and were prominent topics of community and stakeholder input throughout the planning process. Community Meeting and Planning Team Meeting Summaries are available in the documents library of the Midtown Area Regional Center Plan webpage.

Housing Challenges in the Midtown Regional Center

The Midtown area is growing quickly and has rapidly become one of the most attractive areas of the City in which to live for increasing numbers of San Antonians. While Midtown currently has a diversity of housing types and incomes, there is a significant portion of the population that are lower income households as well as mostly renter-occupied housing units (with many renters in single family homes or smaller buildings with 2 to 4 units). This high percentage of renters, particularly the large portion in single family homes, makes these households more vulnerable to displacement as new development occurs and market values increase.

While the percent of Midtown households that are cost burdened for housing has grown commensurate with the City and County averages so far, this may change in the future. New development has attracted new residents to the area who can support the current market rental rates and home prices. While existing and long-term residents have so far been able to remain in the area, the increasing financial pressure on these households from rising rental rates and property taxes may make it hard to remain.

The three main challenges in Midtown related to housing are:

- 1. Potential for Displacement of Existing Residents: Rising rental rates, property values, and home prices will make it harder for lower income residents to remain in the area. This challenge will particularly affect renter households.

- 2. Preserving Historic Character and Reinvesting in Older Housing Stock: The older housing stock gives Midtown amazing character, but will be difficult to maintain due to costs of reinvestment and development pressures.

- 3. Maintaining Opportunity for All Household Types and Incomes to Live in Midtown: The cost of new development and demand for housing in the area make rents and prices for new – and even existing – homes harder for lower income residents to afford.

Housing Recommendations

Housing recommendations were developed based on the Midtown Area’s vision and goals and to address the challenges identified within the plan process. See the Housing Strategy document in the document library for a summary of housing conditions and challenges that provide the basis for the recommendations.